Mt4: ZR3 Pattern EA

The ZR3 Pattern ea (MT4 solely) can be utilized for brief time period pattern reversals in addition to long run trades involving particular targets. It really works greatest on the 1 minute timeframe, particularly when it is set to search for pattern reversals, although it may possibly function on any timeframe.

The primary setting, vary ranges from unfold, is outlined in factors and robotically units up 2 value ranges that make up your reference value vary. The upper value is labeled Vary-high and is represented on a chart with a blue horizontal line. The cheaper price is labeled Vary-low and is represented on a chart with a gold horizontal line. The default worth is 30 and it may be modified to any sensible quantity you need in addition to being modified to zero. When the ea is activated, utilizing the default worth of 30 would set Vary-high at a value degree that’s 30 factors under the present Bid. If for instance the unfold at the moment is 5, the Vary-low worth can be set at a value 5 factors under Vary-high. If the vary ranges worth is ready to 0, both Vary-high and/or Vary-low have to be outlined to ensure that this ea to work. In that case the blue and gold traces will seem on the degree(s) outlined.

The lengthy and brief commerce take revenue settings may be outlined or left at 0. In addition to having the choice to set each, one of many two may be set and the opposite left at 0, or each may be 0. Pending T/P orders won’t be used. If the lengthy take revenue setting is ready and the Bid reaches or passes that value, the ea will shut the commerce. The identical will happen if the brief take revenue setting is ready and the Ask reaches or drops under that value. In both case ZR3 Pattern will likely be faraway from the chart when a revenue goal is reached. The consumer will likely be alerted that this has occurred and that is why this ea is supposed for semi-automated buying and selling types.

The cease worth is outlined in factors and can set a degree for the ea to shut the commerce at if the market goes the mistaken manner. This degree won’t be represented on the chart and it’ll not be a pending order or listed as an S/L worth.

The amount setting will robotically alter to a most or minimal worth if the user-defined quantity is unavailable to commerce with.

Within the case {that a} lengthy commerce is open and a protracted commerce take revenue setting isn’t outlined, the ZR3 Pattern will look ahead to pattern reversals and the worth, if any, of the minimal revenue distance setting. As acknowledged above, this ea works greatest on a 1 minute timeframe. ZR3 Pattern identifies pattern reversals by recognizing sure bar/candlestick patterns. When these happen at a minimal distance (outlined by this setting) away from the order’s entry value, the ea will shut the commerce. ZR3 Pattern can even be faraway from the chart. For the lengthy commerce instance, if the minimal revenue distance setting is 300 and a pattern reversal happens at a value that’s at the very least 300 factors away from the entry value, the commerce will likely be closed at a revenue and the ea will likely be eliminated. In instances the place each the lengthy commerce take revenue setting and the minimal revenue distance setting are 0, and a protracted commerce is open when a reversal happens, the ea will shut the commerce so long as the Bid is 1 level away from the entry value. A corresponding state of affairs will happen when a brief commerce is open and the brief commerce take revenue setting and the minimal revenue distance settings are 0.

The ultimate setting is labeled as most trades allowed. By default the worth is zero. If for instance the worth is ready to five, and trades are stopped out 5 occasions earlier than a revenue is made, ZR3 Pattern will likely be faraway from the chart. This setting permits for a level of management within the whole quantity of losses incurred, particularly throughout value consolidation.

There are three instances that may be initialized with this ea. The primary is the place each Vary-high and Vary-low are outlined. The second is the place solely Vary-high is outlined and the third is the place solely Vary-low is outlined. Within the first case, the Bid has to the touch the vary outlined between Vary-high and Vary-low earlier than breaking above or under that vary. A corresponding Purchase or Promote follows. Within the second case, the Bid needs to be under Vary-high at first. After passing above Vary-high, a Purchase commerce is positioned. Within the third case, the Bid needs to be above Vary-low at first. After passing under Vary-low, a Promote commerce is positioned. If stopped out, the Bid has to succeed in the areas once more earlier than the following commerce is opened. This often occurs virtually instantly if Vary-high and Vary-low will not be adjusted. These processes are repeated till:

– An extended commerce is open and the Bid hits or exceeds the lengthy commerce take revenue value (if outlined)

– A brief commerce is open and the Ask hits or drops under the brief commerce take revenue value (if outlined)

– An extended commerce is open and the pattern reverses, with or with out the minimal revenue distance being outlined, and the lengthy commerce take revenue is undefined.

– A brief commerce is open and the pattern reverses, with or with out the minimal revenue distance being outlined, and the brief commerce take revenue is undefined.

– The utmost variety of trades is outlined and that variety of trades is/are closed.

ZR3 Pattern is robotically eliminated in every of those eventualities. It should be reattached to a chart and the settings outlined once more for additional buying and selling.

A variety of indicators and setup parameters (typically on separate charts) can be utilized to find out the place to set the vary. Worth motion, help and resistance ranges, order circulation, and so on.

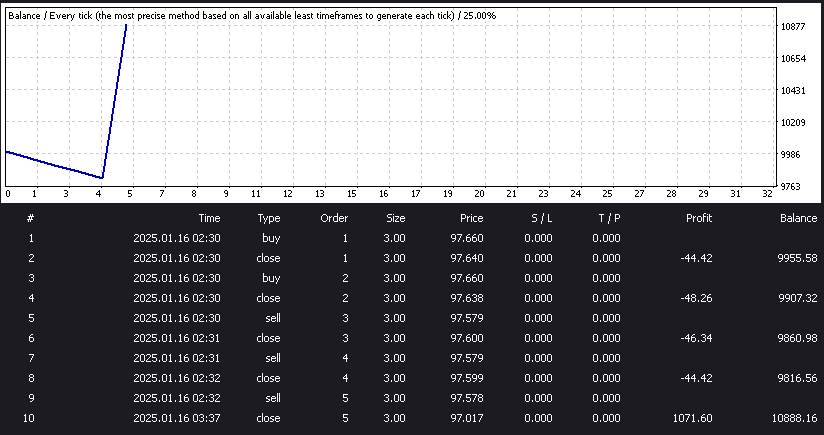

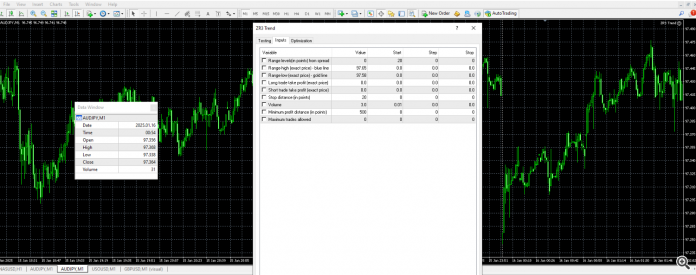

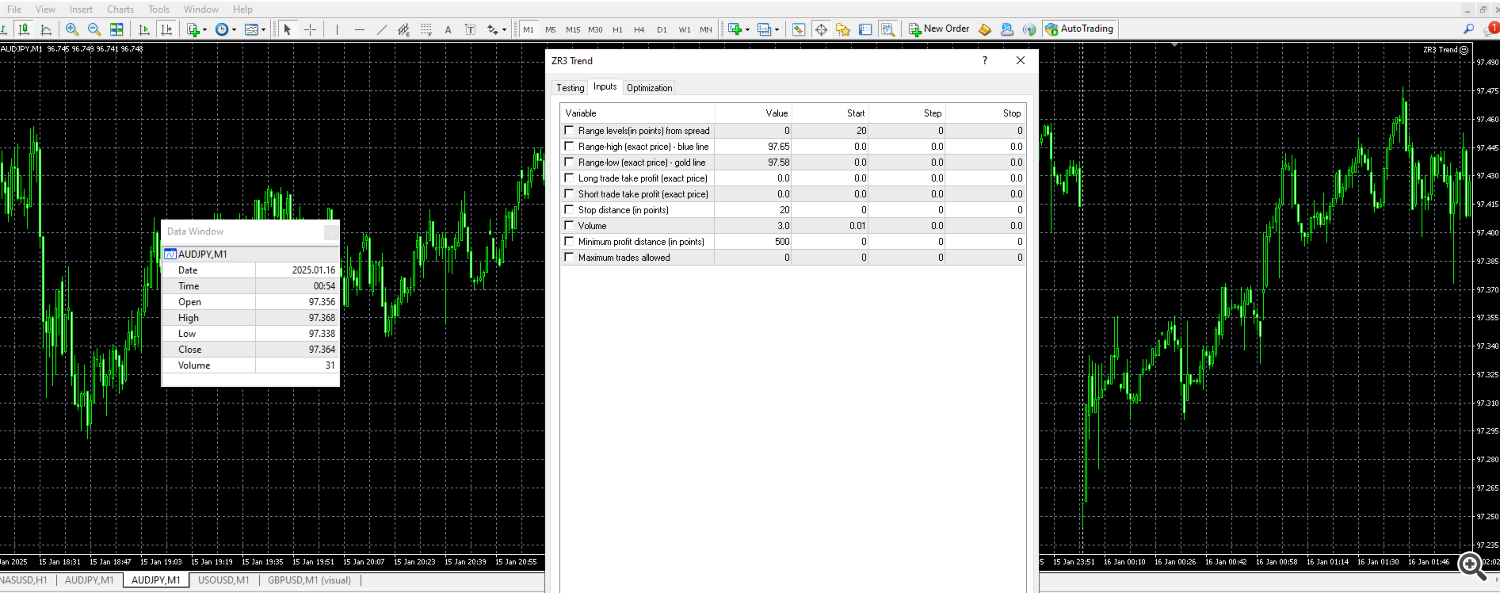

This is an instance of utilizing the ea on a AUDJPY chart. Mt4 technique tester with Coinexx beginning at 2025.01.16. I modified the primary setting, vary ranges, to 0 and set range-high to 97.650 and range-low to 97.580, primarily based on yesterday’s ranges. Lengthy and brief revenue targets left at 0 with a cease distance of 20 factors. Quantity is 3.00 heaps, minimal revenue distance is 500 factors, and no most variety of trades is ready.

Order 1 is a purchase commerce positioned at 2:30 and closed quickly after throughout the identical bar. Order 2 is sort of equivalent, differing by 2 factors on the exit value. Order 3 is a promote commerce additionally positioned at 2:30 and closed on the subsequent bar. Order 4 is one other promote order positioned at 2:31 and closed at 2:32. The ultimate promote order is positioned at 2:32 and is closed at a pattern reversal that’s at the very least the five hundred level minimal revenue distance away from the entry value. The primary 4 trades had been stopped out in a short time as a result of a good cease distance, making an allowance for the unfold of 8-9 factors. The ea was eliminated after the fifth, worthwhile commerce.