What’s the single greatest purpose why most merchants find yourself shedding cash out there? It’s easy: They do an excessive amount of – they suppose an excessive amount of, they have a look at charts an excessive amount of, they commerce an excessive amount of, they threat an excessive amount of and on and on.

What’s the single greatest purpose why most merchants find yourself shedding cash out there? It’s easy: They do an excessive amount of – they suppose an excessive amount of, they have a look at charts an excessive amount of, they commerce an excessive amount of, they threat an excessive amount of and on and on.

Essentially the most profitable merchants and buyers of our time spend 99% of their time ready for alternatives and learning the markets, reasonably than buying and selling them. Roughly 1% of their buying and selling effort is spent executing trades and managing positions. In different phrases, more often than not they’re doing NOTHING. Are you able to say the identical? Or, are you spending 99% of your time coming into and managing trades and just one% of your time ready patiently?

If in case you have ever learn my articles on What Crocodiles Can Educate us about Buying and selling or The Sniper Buying and selling Strategy, it’s apparent that my buying and selling fashion is a low-frequency, high-conviction method. So, why must you undertake an identical method together with your buying and selling? Learn on to seek out out…

The ‘hunt’ entails A LOT of ready.

Simply as a Crocodile spends most of its time stalking its prey, a worthwhile dealer spends most of his or her time stalking good trades. You need to commerce like a predator, not the prey out there, what I imply by that’s, you need to be the dealer who’s ready patiently within the ‘bushes’ for the ‘straightforward kills’. You do not need to be the lots of prey (beginner merchants) who get ‘eaten’ by the skilled merchants each week.

How do you accomplish being the predator and never the prey? It’s easy actually, ready, ready and extra ready.

I wish to say I’m in “hurry up and wait” mode for the proper market situations to current themselves. What this implies is, I’m really excited to attend, as a result of I do know ready means I’m exercising self-control and being affected person and disciplined, and I do know that is the way you generate income within the markets. I’ve no drawback ready for the proper setup to type with the right market confluence, generally for weeks and even months.

The reason being easy, as a result of I do know for a indisputable fact that buying and selling with excessive frequency is the way you lose cash out there and buying and selling with low frequency is the way you grow to be a worthwhile dealer. Each dealer finally learns this truth given sufficient time and expertise out there.

Warren Buffet is a grasp of doing ‘nothing’

My favourite idea and metaphor for instructing folks how I commerce is that of a sniper. The sniper buying and selling method as outlined in my article on this matter, is mainly that I wait patiently like a sniper for my predefined commerce standards to align, reasonably than buying and selling or ‘taking pictures’ at every part like a machine-gunner.

Maybe not surprisingly, that is additionally how the ‘biggest investor ever’ manages himself and his exercise out there. I’m speaking about none apart from the nice Warren Buffet, after all. Take into consideration how he manages billions of {dollars} – it isn’t by coming into the market day by day, that’s for positive! All you could do is learn a ebook about him or watch the latest documentary on him, “Changing into Warren Buffet”, and you will notice he’s a particularly affected person and exact investor.

Not solely is Buffet affected person and exact concerning the transactions he makes out there, when he’s prepared he dives in, boots and all. Generally, he even buys all the firm! You’ll name Mr. Buffet a low-frequency and high-conviction investor. As merchants, we are able to be taught an amazing deal from Mr. Buffet. While we’re doing one thing somewhat totally different than long-term investing or ‘purchase and maintain’, we must always certainly mannequin our swing buying and selling method after Mr. Buffet.

Right here is an efficient quote from commodity buying and selling extraordinaire, Mr. Jim Rogers from The Market Wizards

I simply wait till there may be cash mendacity within the nook, and all I’ve to do is go over there and decide it up. I do nothing within the meantime. Even individuals who lose cash out there say, “I simply misplaced my cash, now I’ve to do one thing to make it again.” No, you don’t. It is best to sit there till you discover one thing.

You see? The purpose right here is that more often than not, worthwhile buyers and merchants are doing ‘nothing’ and by nothing, I imply they aren’t coming into trades or managing trades. They could certainly be learning or analyzing the market within the meantime, however this is able to depend as ‘stalking’ their prey.

Change how you concentrate on doing ‘nothing’

It’s innate for us people to desire a ‘fast thrill’ in all that we do. Continuously checking social media on our telephones has been confirmed to extend the quantity of dopamine (the feel-good chemical) in our mind, for instance. We’re a society hooked on doing what feels good extra typically than doing what IS good. We’re born with a gamblers or speculators mind, looking for prompt rewards and thrills in life and with cash.

Relating to buying and selling, the ramifications for such habits will be extreme.

It could actually result in treating your buying and selling account as if it’s a slot machine. Many merchants find yourself coming into trades, one after one other, as if they’re pulling the arm of a slot machine time and again in a on line casino. After all, the distinction is, we sometimes anticipate to lose at a on line casino, so most of us don’t take cash that we’d like. In buying and selling, many individuals consider they are going to be worthwhile due to some ‘innate capability’ they’ve and they also typically threat greater than they need to or commerce with cash they actually can’t afford to lose. After all, as soon as they begin buying and selling and get the dopamine repair, it turns into an habit that results in blowing out their buying and selling accounts.

How do you modify this toxic buying and selling mentality?

The most effective guidelines anyone can study investing is to do nothing, completely nothing, until there’s something to do. Most individuals – not that I’m higher than most individuals – all the time need to be taking part in; they all the time need to be doing one thing. They make a giant play and say, “Boy, am I good, I simply tripled my cash.” Then they rush out and need to do one thing else with that cash. They will’t simply sit there and look forward to one thing new to develop. – Jim Rogers

The way in which that we circumnavigate our personal flawed buying and selling mindsets, is to easily perceive, settle for after which embrace the thought of doing nothing. Embrace what you contemplate ‘boring’ and mediate on it. Ultimately, after a number of huge buying and selling wins that resulted from you ready patiently for extremely confluent trades, you’ll begin to re-align your thought processes and the dopamine rush you used to get from coming into trades and messing round with them whereas they have been reside, will shift to the intervals of time you might be ready and stalking the market. Once you really feel such as you’re not doing sufficient, you’re in the proper zone, it’s essential to grasp with the ability to do nothing and you are able to do this by discovering one thing else to interchange that ‘void’.

When you understand that being affected person and learning the market or just not even trying on the market in any respect, will make you extra money within the long-run than the other, your mind chemistry will start to ‘flip’, and shortly you’ll be trying ahead to the ‘hunt’, even when it means ready two weeks between trades.

Conclusion

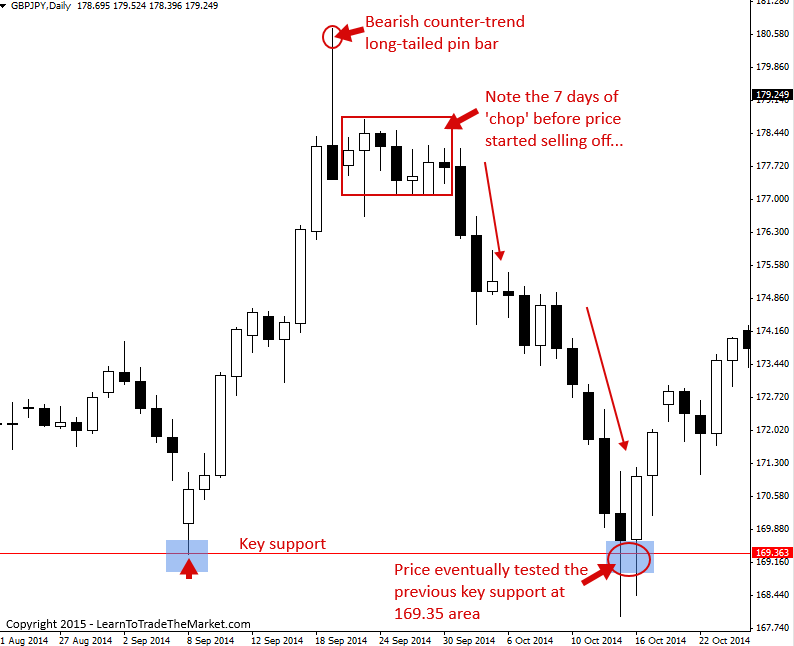

The Market is slower than we think about, and trades can take a very long time to play out. Take the chart beneath for instance: It exhibits that endurance is required to seize the massive strikes, and we should ignore the short-term ‘shake outs’ that trigger most merchants to over-think and exit prematurely…

The value motion setups that I commerce don’t seem extraordinarily typically, and once we apply my TLS filtering rule and look forward to that confluence, the buying and selling alternatives are diminished much more. My buying and selling programs can share my buying and selling technique however they will’t power you to be affected person and wait it out for the proper alternative to reach. It’s one factor to be assured in recognizing trades, however are you assured in your capability to not over-trade even within the face of fixed temptation by the charts? If that is your weak point (and I assume it’s for many studying this), spend MORE time getting that side of your buying and selling proper, and I assure you that your account stability will thanks.

I WOULD LOVE TO HEAR YOUR THOUGHTS, PLEASE LEAVE A COMMENT BELOW 🙂

ANY QUESTIONS ? – CONTACT ME HERE