The lottery guarantees colossal money in a flash, whereas the AI inventory presents gradual monetary progress.

Received $321 for an opportunity to supercharge your wealth? That quantity is how a lot the typical American spent on lottery tickets in 2023, in line with analysis carried out by The Motley Idiot utilizing the latest information obtainable from the U.S. Census Bureau.

Winners of the Powerball jackpot in September took residence almost $2 billion. A shot at that form of transformative revenue could make a $321 funding seem worthwhile.

How does that potential payout evaluate to placing cash into one of many hottest shares round — semiconductor chip chief Nvidia (NVDA 1.90%)? Its shares are up round 40% this yr alone as of Oct. 6. Evaluating an funding in Nvidia versus the lottery can present insights into how greatest to deploy your hard-earned money.

Picture supply: Nvidia.

The lottery dream in distinction to actuality

The lottery’s get-rich-quick attract makes the gamble appear to be a no brainer. Furthermore, the prizes are anticipated to solely enhance in worth over time. Lottery organizers are motivated to take action as a result of they seen People are inclined to spend extra on tickets when the jackpots are bigger.

This helped states with lotteries rake in a file $103 billion in 2023 ticket gross sales. However that does not essentially translate into riches for you. Your odds of successful a life-changing Powerball jackpot are a microscopic one in 292 million.

This actuality contributes to lottery organizers in search of to entice you with more and more greater jackpots. It permits them to develop income in change for handing out rewards to just some winners.

How Nvidia inventory stacks up in opposition to the lottery

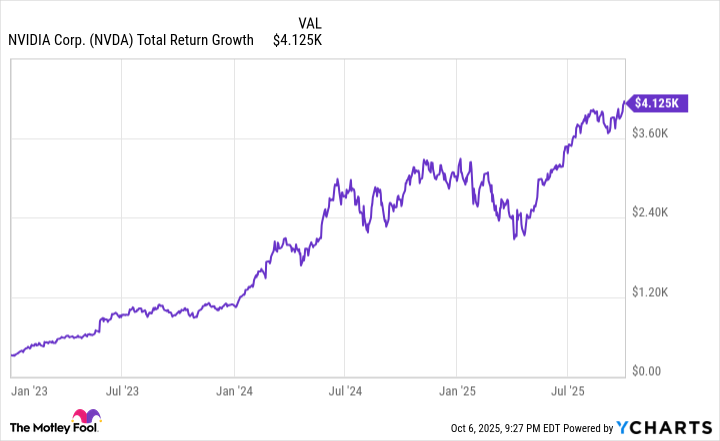

If lottery gamers had put their $321 into Nvidia in 2023, how would which have panned out? This chart reveals what would have occurred in hindsight.

Information by YCharts.

Because the chart exhibits, each one that invested $321 firstly of 2023 would have seen that whole develop to hundreds of {dollars} in simply a few years. The end result is not life-changing, but it surely’s far superior to no return for the overwhelming majority of People who performed the lottery.

Whereas the longer term is unsure, it is potential to see an Nvidia funding develop by shopping for extra shares and holding on to them for the long run. The technique is smart with Nvidia because it’s on the forefront of synthetic intelligence (AI).

AI expertise is reworking industries from healthcare to finance. Governments around the globe are pouring billions of {dollars} into AI. Nvidia is central to AI adoption as a result of its chips are the important thing to delivering the computational energy wanted for AI techniques to carry out their jobs.

Consequently, Nvidia’s income in its fiscal Q2, ended July 27, soared 56% yr over yr to $46.7 billion. The corporate forecasted its gross sales to rise additional in fiscal Q3, reaching $54 billion.

The Q3 prediction signifies the chance to put money into Nvidia is not over. Including to that is the corporate’s blockbuster bulletins of offers with Intel and ChatGPT creator OpenAI in September. These partnerships possess the potential for Nvidia to deploy tens of millions of its AI chips in assist of constructing out much-needed tech infrastructure, holding the promise of skyrocketing gross sales sooner or later.

The trail to wealth accumulation

Placing cash into Nvidia again in 2023 would have been a sensible transfer, however after all, that is straightforward to say now. In spite of everything, not each inventory goes to ship that form of excellent return, and it isn’t a given which one will achieve this.

That is the place investing in the inventory market actually shines. You do not want to decide on a standout like Nvidia to see your funding develop.

Over the trailing 10 years, the inventory market’s whole return was greater than 250%. Whereas the lottery’s siren name of immediate riches sounds compelling on the floor, the truth is that you’ve got a a lot better probability of accelerating your fortune on Wall Avenue.

That is very true should you observe basic ideas to construct a robust funding portfolio. Nearly all of People are already profiting from the worth of investing with 62% of U.S. adults proudly owning shares.

Even a meager sum to start out can develop into huge bucks that may allow you to retire a millionaire. That is a greater use of $321 than lottery tickets.