XRP gained 42% prior to now week, after rallying near 1% on Friday. The altcoin hit a brand new all-time excessive, with the 24-hour commerce quantity leaving Ethereum (ETH) to chew the mud on Thursday. The token may lengthen its streak within the coming days following President-elect Donald Trump’s inauguration.

XRP may lengthen rally alongside Bitcoin

XRP rallied over 40% prior to now week. Bitcoin (BTC), the most important cryptocurrency recovered from its flashcrash below $90,000 and made a comeback above $104,000 on Friday. The native token of the XRPLedger is rallying alongside the highest crypto.

Trump’s upcoming inauguration is without doubt one of the main catalysts, alongside optimism on crypto regulation, pro-crypto coverage and a brand new method by monetary regulatory businesses within the U.S.

XRP may acquire additional, getting into value discovery subsequent week.

XRP trades at $3.26 on the time of publication.

On-chain indicators help positive factors

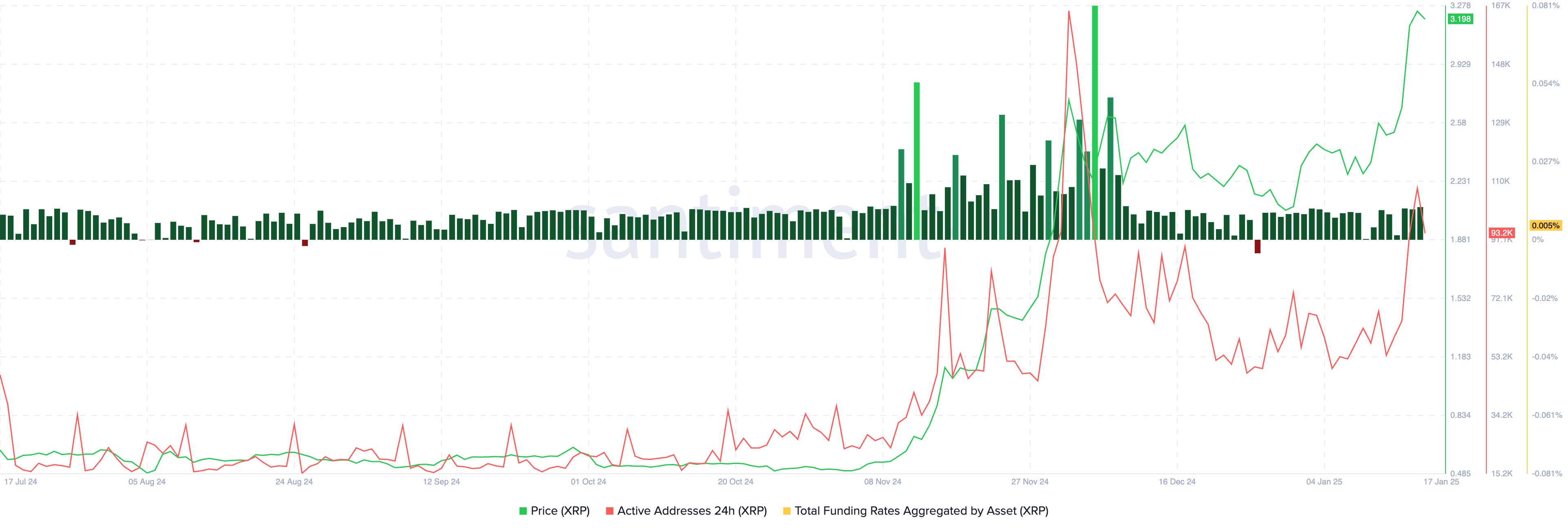

XRP’s on-chain indicators help a bullish thesis for the altcoin. The whole funding price metric is optimistic, higher than one all through January 2025. The depend of energetic addresses recorded a big spike on Thursday, Jan. 16.

The on-chain indicators on Santiment are conducive to additional positive factors in XRP within the coming week.

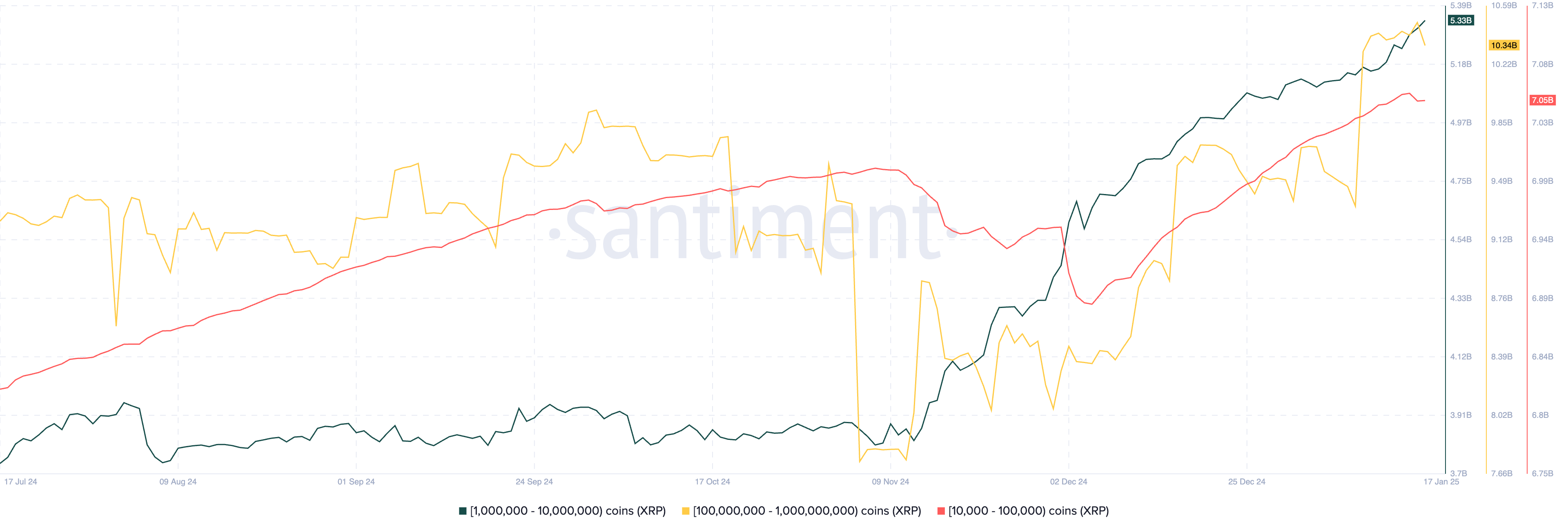

The availability distribution metric on Santiment reveals a rise in XRP token provide held by wallets that personal 10,000 to 100,000, 1 million to 10 million and 100 million and above XRP tokens. The three lessons of holders have accrued the altcoin, whilst the worth climbs. That is indicative of a possible XRP value enhance sooner or later.

Market movers and Ripple lawsuit

Monday’s inauguration is the most important market mover in crypto. However RippleNet’s rising adoption amongst establishments, the developments in RLUSD stablecoin and the SEC’s lawsuit towards Ripple are the three key market movers influencing the altcoin’s value.

Even because the U.S. monetary regulator filed an enchantment towards Ripple on Jan. 15, the altcoin continued its rally undeterred. The July 2023 ruling by Choose Analisa Torres that categorized secondary gross sales of XRP as non-securities is being challenged and the SEC is searching for to have these retail gross sales categorized as unregistered securities gross sales.

Ryan Lee, chief analyst at Bitget Analysis, instructed crypto.information in an unique interview:

“XRP’s surge will be attributed to favorable outcomes in Ripple’s SEC lawsuit and a extra crypto-friendly political local weather within the US. If regulatory uncertainties are resolved, the inflow of institutional buyers may additional solidify XRP’s place within the crypto market.”

It stays to be seen whether or not the Trump administration will help pro-crypto regulation and whether or not it influences the end result of lawsuits towards companies like Ripple Labs.

Technical evaluation and XRP value forecast

XRP is hovering near its all-time excessive at $3.40. On the time of writing, XRP traded at $3.2385. A 22% value rally may push XRP into value discovery, on the 141.4% Fibonacci retracement stage of the climb from the $1.9054 low to the $3.4000 peak.

The technical indicators, RSI and MACD help a bullish thesis for XRP. MACD flashes consecutive inexperienced histogram bars. Merchants have to preserve their eyes peeled as RSI indicators that the token is at present overbought or overvalued, because it reads 83.

Within the occasion of a correction, XRP may discover help on the 50% Fibonacci retracement stage at $2.6977.

James Toledano, COO at Unity Pockets, instructed crypto.information in an unique interview:

“On condition that XRP was caught at round $0.50 for actually 3 years, its latest breakout momentum displays new ranges of investor optimism round regulatory readability and the potential approval of an XRP ETF within the following months. If the XRP ETF will get permitted, it would have the potential to open the floodgates of capital influx, which means it may attain new heights in 2025.”

Toledano warns XRP holders to be cautious as altcoins take volatility to the following stage within the present market cycle.

He mentioned:

“Altcoin ETFs have real potential to draw capital, particularly if supported by innovation-friendly insurance policies with the brand new incoming U.S. administration. However, their success could also be much less constant in comparison with Bitcoin ETFs as a result of seemingly episodic nature of curiosity in altcoins.

Simply check out fluctuations in Bitcoin’s value this week. The elements are multifaceted; let’s imagine it’s Trump, seasonality, geopolitics, macroeconomics and sentiment all blended collectively. To play satan’s advocate, we people are sample seekers however typically there are hidden drivers and the trigger and results will not be all the time linked.”

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.