Be a part of Our Telegram channel to remain updated on breaking information protection

Zcash (ZEC) has confronted notable volatility recently, retracing considerably from its current peaks whereas sustaining beneficial properties from its current lows. Regardless of these fluctuations, the cryptocurrency exhibits indicators of resilience and renewed curiosity from merchants on X. Given the present market dynamics and technical alerts, the urgent query is: will ZEC be capable of flip this rebound right into a sustained upward development?

ZEC Key Statistics

- Present Worth: $349

- Market Cap: $5.8 billion

- Buying and selling Quantity (24h): $1.17 billion

- Circulating Provide: 16 million ZEC

- Whole Provide: 16 million ZEC

- CoinMarketCap Rating: #22

Over the previous 30 and seven days, Zcash has fallen by 51.90% and 35.22% from its current highs, reflecting a notable pullback. Regardless of this, the cryptocurrency has risen 15.05% from its lowest value throughout the identical durations, displaying indicators of resilience and potential restoration.

ZEC/USD Market

Key Ranges

- Resistance: $400, $470, $550

- Assist: $320, $280, $240

ZEC/USD sits close to $349.15 on the chart, retracing closely from its $744 peak and transferring steadily beneath the Parabolic SAR markers that proceed to replicate a bearish tone. The general circulation of value motion stays downward, with constant decrease highs and decrease lows shaping sentiment. For any upside shift to take type, ZEC would wish to problem and clear resistance ranges round $400, $470, and $550—zones the place prior rallies misplaced momentum and sellers reasserted management.

The RSI studying at 38.63 factors to rising exhaustion within the downtrend, creating the likelihood—although not the assure—of a short-term corrective bounce if consumers start to indicate curiosity. Ought to promoting stress proceed unchecked, the market could gravitate towards helps close to $320, $280, and $240, every tied to earlier consolidation phases. How ZEC behaves round these areas might decide whether or not the market finds a short lived ground or slides right into a deeper retracement, making upcoming value reactions particularly vital to look at.

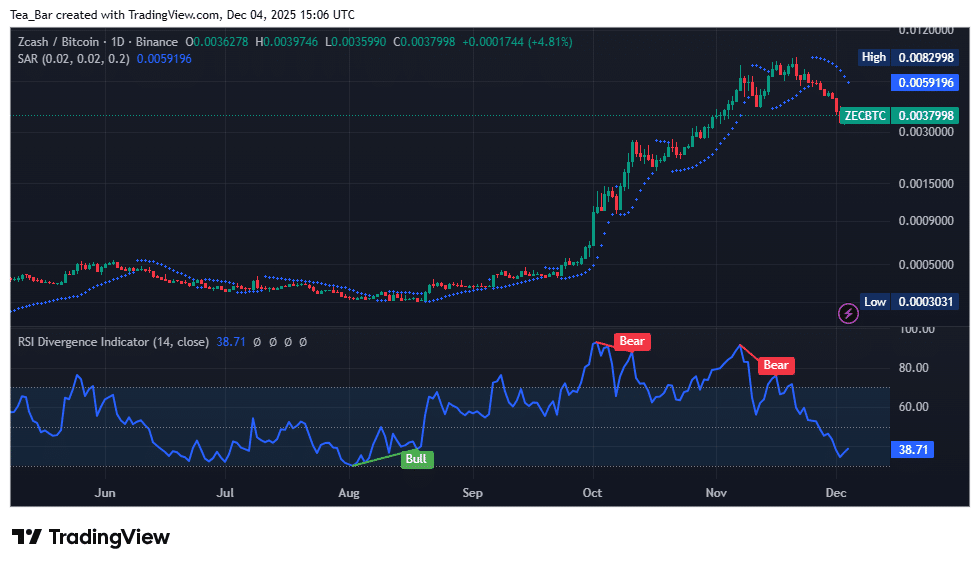

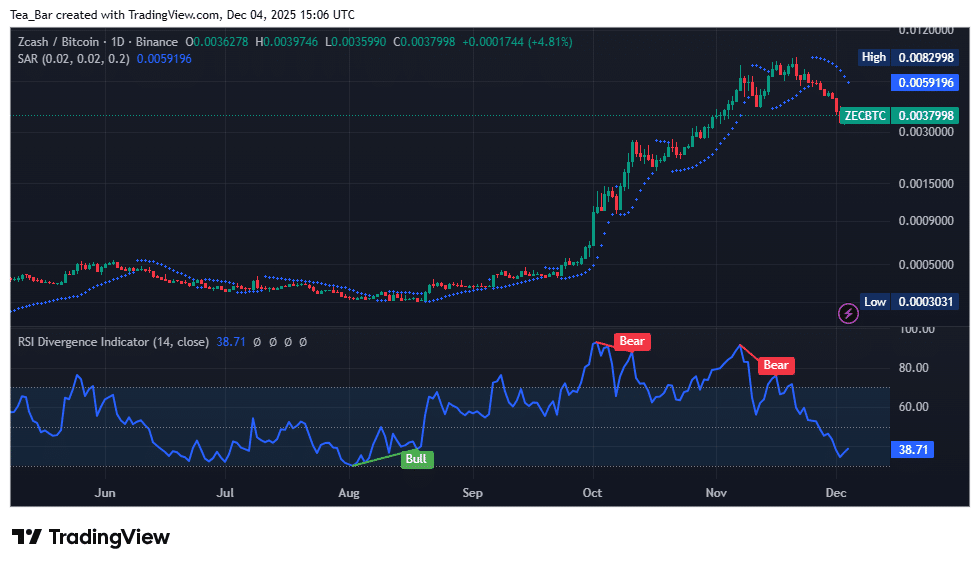

ZEC/BTC Efficiency Insights

ZEC/BTC is at present buying and selling round 0.0037998, displaying a continued pullback from its 0.0082998 peak because the Parabolic SAR dots stay above the candles, indicating ongoing bearish momentum. The decline is additional supported by a weakening RSI at 38.71, reflecting sustained draw back stress after consecutive bearish divergences in October and November. Until the pair can reclaim ranges close to 0.0042000 or increased to shift market sentiment, it stays vulnerable to additional pullbacks towards the following demand zones, making the upcoming value motion vital in assessing whether or not consumers are able to defend the present vary.

Current exercise highlighted on X suggests that $ZEC has been rebounding over the previous few days, performing comparatively higher than many different altcoins. Analysts on X interpret this motion as indicative of a attainable rounded backside forming, which might sign the beginning of an rising upward development. This interpretation factors to the potential for short-term momentum beneficial properties, attracting renewed curiosity from merchants searching for promising alternatives within the altcoin market.

Zcash Fundamentals: Privateness, Adoption, and Market Potential

Zcash’s fundamentals are more and more formed by its technological upgrades and adoption potential. The Sapling community improve in October 2025 drastically lowered shielded transaction prices, making non-public funds extra sensible, whereas Ztarknet, a Starknet-inspired Layer 2, goals to scale transactions past 1,000 TPS with out compromising privateness. These enhancements might drive progress within the shielded pool, which at present represents 29% of ZEC provide, and traditionally, main protocol upgrades like Halo 2 in 2024 have coincided with substantial rallies. Change listings on platforms like Coinbase and Gemini additionally improve liquidity, although they might introduce short-term volatility.

Zcash (ZEC) : Extra Basic and Technical Insights

Regulatory and institutional elements add a nuanced layer to Zcash’s outlook. Whereas the SEC’s rejection of leveraged crypto ETFs alerts warning, institutional adoption continues, with Grayscale’s ZEC Belief and Cypherpunk Applied sciences holding notable positions. Zcash’s opt-in transparency could entice compliance-minded establishments, balancing issues over privateness coin rules in areas just like the EU. Market dynamics, together with excessive volatility and whale exercise, additional affect value motion. With these developments in thoughts, the important thing query stays: can Zcash’s shielded transactions attain 50% of provide by 2026, solidifying its “privacy-first” narrative?

Associated Information

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection